How easy is it to buy fake paystubs online? Our first-hand account

Application fraud in the multifamily industry surged during the COVID-19 Pandemic and remains a thorn in the side of property managers. Among the various forms of fraud, the most prominent is the use of forged income documents, such as paystubs and bank statements. In this post, we’ll delve into the world of rental application fraud, demonstrate how easy it is for individuals to obtain highly-convincing fake documents, and shed light on how Celeri's fraud detection engine is helping property managers stay one step ahead.

It’s easier than ever to commit fraud

Among the various tactics employed by fraudsters, the most prevalent one involves falsifying income documents. You might be surprised to learn that forging these documents is not a difficult task. Many individuals are doctoring documents, utilizing everyday software like Adobe. However, for those seeking a shortcut, they can look to social media platforms.

How we bought a fake paystub on Twitter

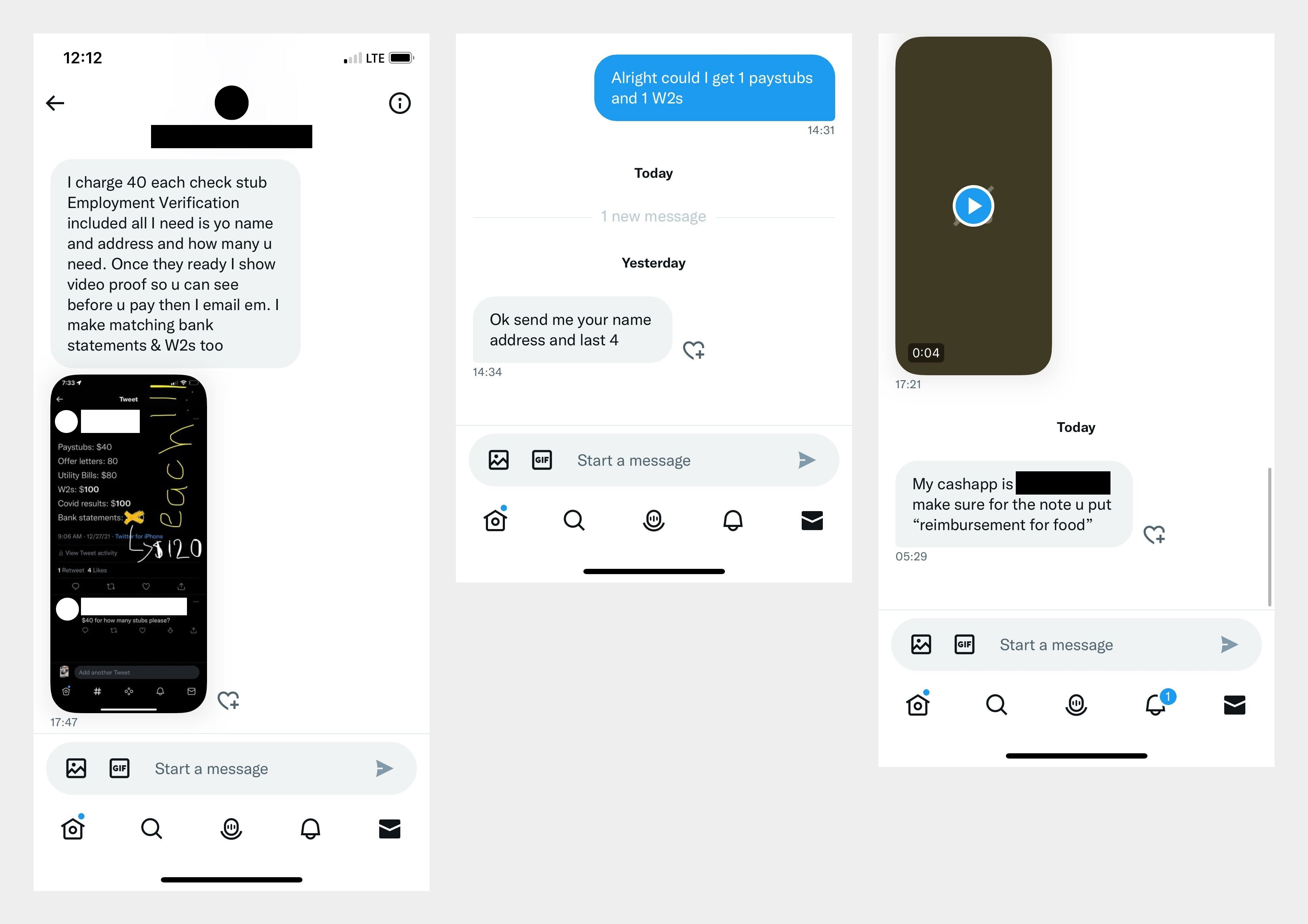

A quick search for "fake paystubs" on Twitter or Instagram reveals an illicit marketplace where people openly advertise and sell high-quality counterfeit documents. To better understand this world, we decided to buy some documents ourselves.

The process was remarkably simple. To create the fake documents, the seller requested some basic pieces of information: name, address and last four digits of our social security number. Initially, we inquired about purchasing a single paystub. However, the seller was knowledgeable about the typical requirements for an apartment application and attempted to upsell us by offering multiple paystubs and bank statements, all with matching deposit amounts.

Within 24 hours, they notified us that the documents were ready for purchase. The paystub cost us $40 and the payment was sent via CashApp, with explicit instructions from the seller to label the payment as "reimbursement for food."

The fake document

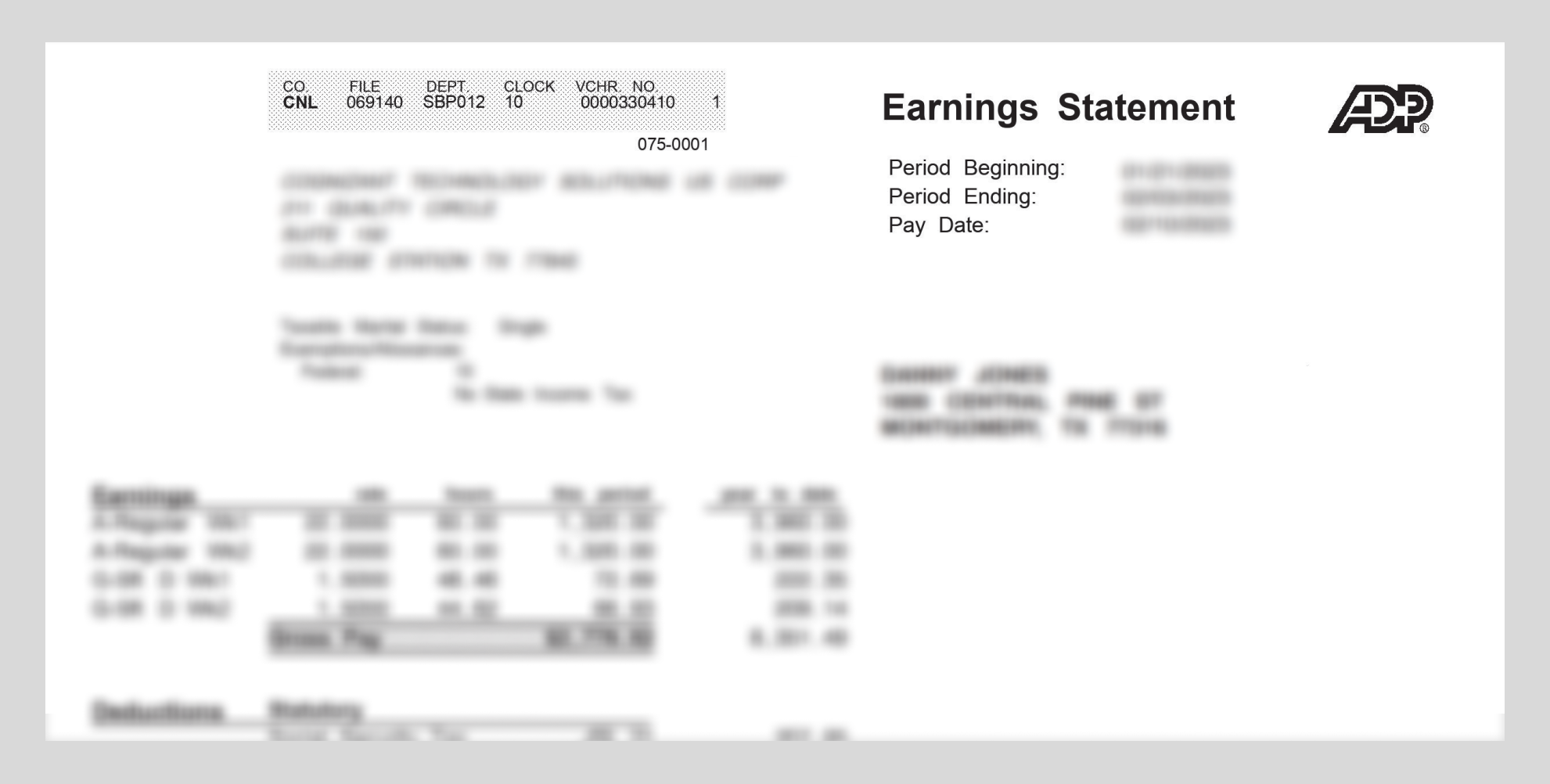

What we received in return was a picture-perfect ADP paystub, so convincing that when we showed it to numerous property managers, not a single one suspected it to be fraudulent. There were no discernible visual cues that would tip off even the most experienced property managers.

Celeri's data-driven fraud detection

Fortunately, Celeri's systematic approach to fraud detection goes beyond visual inspections. Our AI-driven system analyzed the underlying data, or "digital fingerprint," of the document. In mere seconds, our system automatically detected that this document is not genuine.

The cost of rental fraud

The effects of fraudulent renters are costly. Backed by data from backtests with our partners, we've found that more than 50% of evictions stem from renters who were initially approved with fraudulent documents. The average eviction comes at a cost of $7,000 in lost rent and associated expenses. The losses can be much higher in jurisdictions where eviction moratoriums from COVID-19 have ended over the last year and courts are still backed up.

Celeri’s solution

With Celeri, property managers not only save on bad debt but also gain peace of mind. Our solution frees up leasing staff from the taxing task of playing detective and chasing down employers (note that some of these fake document sellers even offer to be an employer reference for an extra cost).

If you would like to see a demo and discover how Celeri's fraud detection engine can help you defend against application fraud, saving you time, money, and stress, reach out below.