The Changing Landscape of Rental Screening

What Property Managers Need to Know

Rental screening is undergoing a rapid transformation as fraudsters become more sophisticated and more prevalent. For property managers, staying ahead of these evolving tactics requires vigilance in a complex risk environment.

At Esusu Identity Services (EIS), formerly known as Celeri and now part of Esusu, we work with multifamily operators across the country, and we're seeing consistent themes emerge in how fraud is perpetrated and, more importantly, how it can be stopped. Below are the most important trends we’re seeing, along with how EIS is helping operators get ahead.

At Esusu Identity Services (EIS), formerly known as Celeri and now part of Esusu, we work with multifamily operators across the country, and we're seeing consistent themes emerge in how fraud is perpetrated and, more importantly, how it can be stopped. Below are the most important trends we’re seeing, along with how EIS is helping operators get ahead.

1. Proof of Income Fraud is at an All-Time High

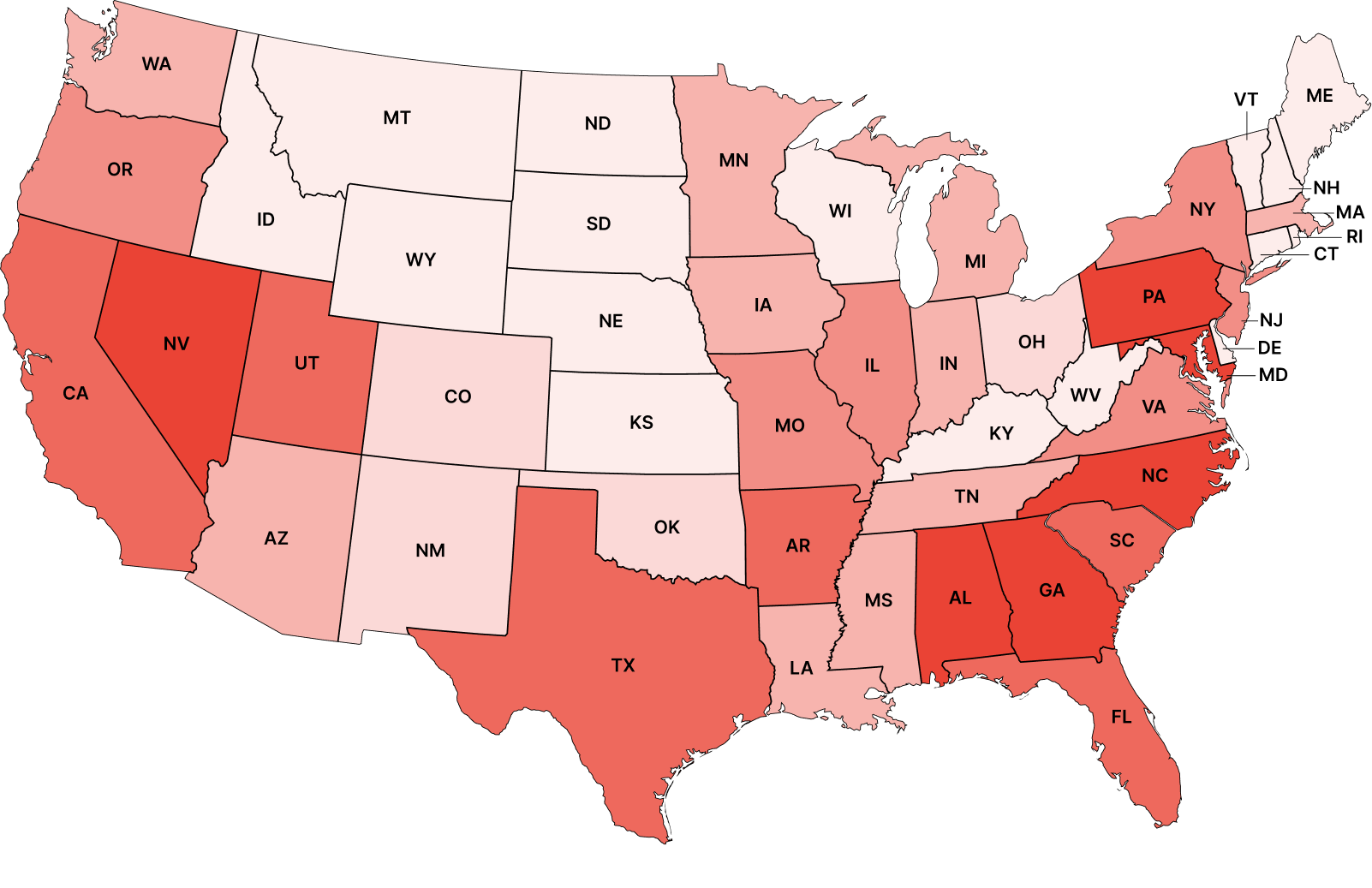

Proof-of-income fraud is the most common type of fraud in multifamily leasing. Nationally, about 10% of applicants submit false income documents and, in markets like Atlanta, that number can climb past 20%.

Editing pay stubs and bank statements has become almost trivial. Online, it’s easy to find individual and services that sell convincing counterfeits with turnaround times under 24 hours.

EIS Solution

Our AI-powered document analysis system goes beyond visual inspection. It detects subtle signs of document tampering, identifies inconsistencies, and flags anomalies with high precision, helping you catch fraud before it becomes a lease.

Editing pay stubs and bank statements has become almost trivial. Online, it’s easy to find individual and services that sell convincing counterfeits with turnaround times under 24 hours.

EIS Solution

Our AI-powered document analysis system goes beyond visual inspection. It detects subtle signs of document tampering, identifies inconsistencies, and flags anomalies with high precision, helping you catch fraud before it becomes a lease.

In some extreme cases, fraud rings even create real legal entities, purchase payroll software, and generate “authentic” pay stubs they then sell to prospective renters.

Our recommendation: Always collect multiple months of bank statements alongside pay stubs to confirm that deposits are actually being made.

US Fraud Heat Map

Bank-linking is a powerful tool, but it comes with gaps

More operators are starting to use open banking tools like Plaid to connect directly to an applicant’s bank data. This gives leasing teams direct access to first-party direct deposit data, reducing reliance on potentially falsified documents.

But this approach isn’t bulletproof:

EIS Solution

We’re expanding to support bank and payroll linking, offering a more robust first-party data option. But even with linking, document uploads won’t go away, which is why our document fraud detection remains essential. Whether an applicant links their account or uploads files, you’re covered.

More operators are starting to use open banking tools like Plaid to connect directly to an applicant’s bank data. This gives leasing teams direct access to first-party direct deposit data, reducing reliance on potentially falsified documents.

But this approach isn’t bulletproof:

- Not all banks are covered by open banking providers.

- Many applicants are uncomfortable sharing login credentials, citing privacy or security concerns.

EIS Solution

We’re expanding to support bank and payroll linking, offering a more robust first-party data option. But even with linking, document uploads won’t go away, which is why our document fraud detection remains essential. Whether an applicant links their account or uploads files, you’re covered.

2. Identity Fraud: The Invisible Applicant Problem

According to an NMHC survey, 70% of operators experienced identity fraud in the prior year. Fraudsters use fake or stolen identities to avoid accountability. This can lead to situations where the occupant of a unit is unknown, making eviction difficult if the person does not exist in public records.

In addition, not knowing who is entering your community can pose safety concerns for residents and staff.

EIS Solution

Our identity verification solution cross-checks applicant information against regulated databases, analyzes ID documents for signs of tampering, and performs biometric comparisons to help detect both stolen and fabricated identities.

In addition, not knowing who is entering your community can pose safety concerns for residents and staff.

EIS Solution

Our identity verification solution cross-checks applicant information against regulated databases, analyzes ID documents for signs of tampering, and performs biometric comparisons to help detect both stolen and fabricated identities.

3. CPNs Cast Doubt on Credit Reports

When someone has poor or no credit, they may turn to a so-called Credit Privacy Number (CPN). These are often pitched as legal alternatives to Social Security Numbers, but in reality, they’re almost always stolen or fabricated SSNs. Fraud rings take advantage of gaps in the credit reporting ecosystem to create and build up these entirely fake credit profiles that look legitimate but don’t reflect the applicant’s true creditworthiness.

EIS Solution

We’re actively building a CPN detection solution that identifies cases of synthetic profiles, leveraging signals extracted through a consortium of data sources.

EIS Solution

We’re actively building a CPN detection solution that identifies cases of synthetic profiles, leveraging signals extracted through a consortium of data sources.

4. Landlord References Are Dying, but Rental Payment Data is More Valuable Than Ever

Rental payment history is one of the most predictive indicators of future payment behavior. And yet, landlord reference calls are rarely performed anymore. It’s time-consuming to chase down prior landlords and they are generally not incentivized to provide the information as it can open them up to liability.

EIS Solution

We’re building a rental history verification tool that changes the game. Leveraging Esusu’s existing rent reporting data and user-permissioned bank transaction data, we’ll be able to confirm whether applicants paid rent on time in a matter of minutes.

EIS Solution

We’re building a rental history verification tool that changes the game. Leveraging Esusu’s existing rent reporting data and user-permissioned bank transaction data, we’ll be able to confirm whether applicants paid rent on time in a matter of minutes.

Final Thoughts

Fraud is here to stay and it’s only becoming more sophisticated. The good news is that operators don’t tackle it alone. At EIS, we’re committed to helping operators stay ahead with tools that are precise, scalable, and built for the realities of today’s leasing environment.

If you're ready to take a smarter approach to rental screening, we’re here to help.

If you're ready to take a smarter approach to rental screening, we’re here to help.

Request a Demo

Catch fraud before it turns into costly evictions.