Most Commonly Modified Income Documents in Rental Applications

From our unique vantage point of verifying thousands of documents every day, we wanted to share exactly which documents we see the highest rates of fraud.

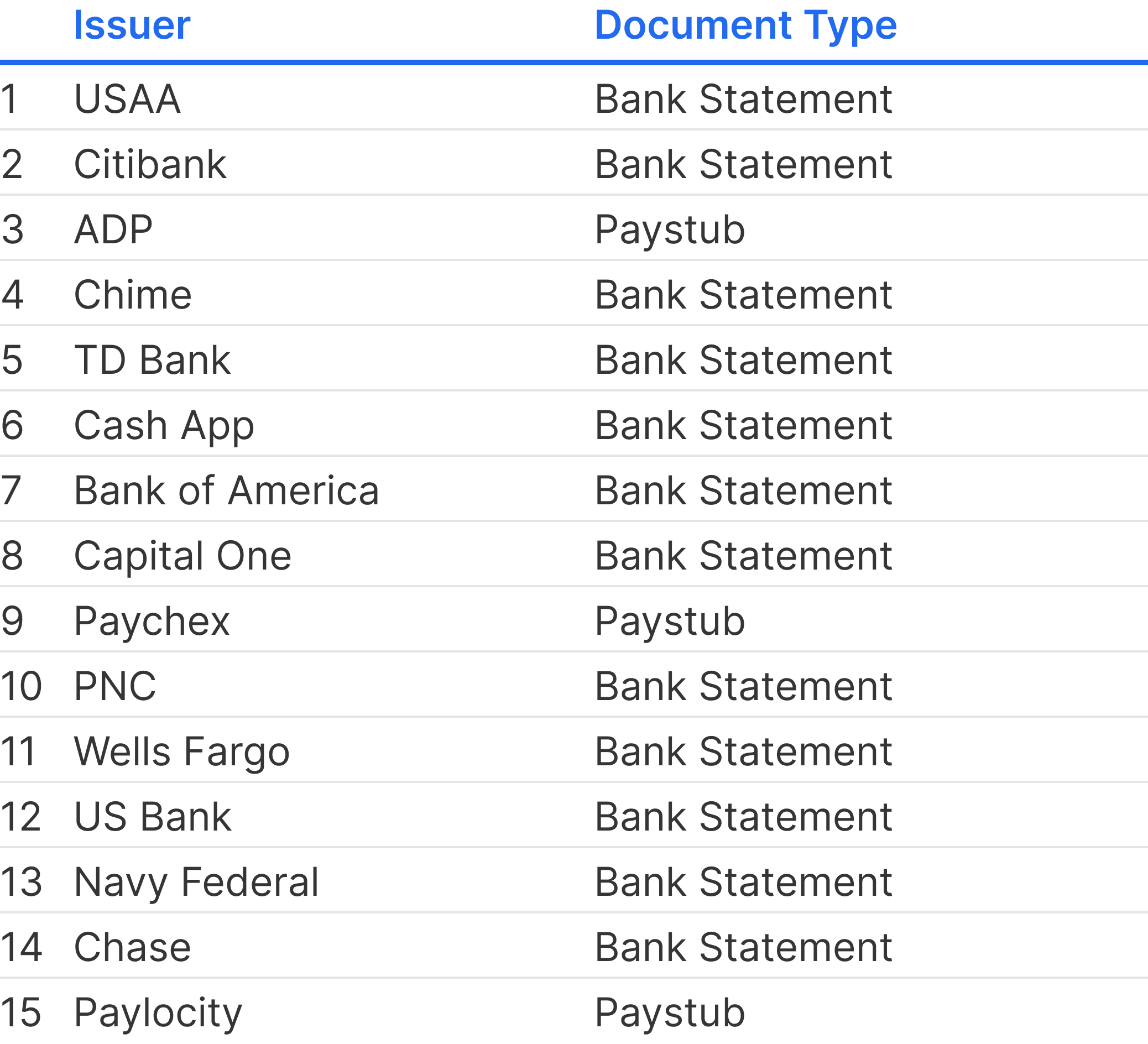

Most Commonly Received Documents

Here are the documents that we most commonly receive across the country. As expected, the list of issuers represents the largest financial institutions and payroll systems:

Highest Rate of Fraud

However, certain issuers appear to be targeted more frequently by fraudulent applicants. The list outlines the paystubs and bank statements that have the highest rates of fraud.

Addressing the Issue

The rise of fraud poses significant challenges for the multifamily real estate industry. Approximately 1 in 10 rental applications include fraudulent income documents and the average cost of an eviction is $7,000 in lost rent and legal expenses.

To combat the issue, it is crucial for operators to implement robust verification processes and invest in advanced technology that can effectively detect fraudulent documents. With Celeri, operators can affordably safeguard their properties against bad actors. At $0.99 per unit per month or $9.99 per applicant, preventing even one case of fraud per year yields a positive ROI for most properties.

What are the most commonly modified income documents you’ve seen? What measurements do you have in place to protect your portfolio?